What Are Mergers & Acquisitions (M&A)?

Mergers and acquisitions (M&A) refer to the process by which companies consolidate through various forms of financial transactions. These transactions typically involve one company merging with another to form a single entity or one company acquiring another and absorbing its operations. M&A activities are a common strategy used by businesses to expand market share, enhance operational efficiency, or gain a competitive edge.

A merger occurs when two companies of similar size agree to combine and operate as a new entity. An acquisition, on the other hand, involves one company taking control of another. The acquiring firm may need to take active steps, such as buying stakes, particularly in hostile takeovers where consent from the target is not given. The acquired company may continue operating under its existing name or be absorbed entirely into the parent organization.

How Mergers & Acquisitions Work

M&A transactions follow a structured process, involving research, valuation, negotiation, and integration. The investment banking industry plays a crucial role in facilitating these transactions by providing expertise and resources. The objective is to create a stronger, more competitive company with improved market positioning. These deals require extensive due diligence to assess financial performance, legal risks, and cultural compatibility between the companies involved.

Key Stages of Mergers & Acquisitions

1. Strategic Planning

Companies identify M&A as part of their growth strategy. They determine whether a merger or acquisition aligns with their long-term business goals, such as expanding into new markets, acquiring intellectual property, or achieving cost efficiencies.

Evaluating the business models of potential acquisition targets is crucial during the strategic planning stage to ensure they complement the company’s objectives and enhance market share.

2. Target Identification and Evaluation by the Acquiring Company

Companies research and identify potential acquisition targets or merger partners. The evaluation process considers the financial health, market position, and potential synergies of the target business. Due diligence is crucial in determining the feasibility of a deal.

3. Business Valuation and Negotiation

A valuation is conducted to determine the worth of the target company. The role of the target company’s board is crucial in the negotiation process, as their approval can significantly impact whether the deal is friendly or hostile. Negotiations focus on purchase price, deal structure, financing, and integration plans. Both parties must agree on the terms before proceeding.

4. Regulatory Approvals

Depending on the size and industry, M&A deals may require approval from regulatory bodies. Antitrust laws and industry-specific regulations must be considered to avoid legal complications.

5. Integration Planning for the Acquired Company

After the deal is finalized, the combined company begins the process of integrating operations, workforce, and technology. This stage is critical in determining whether the M&A achieves its intended goals.

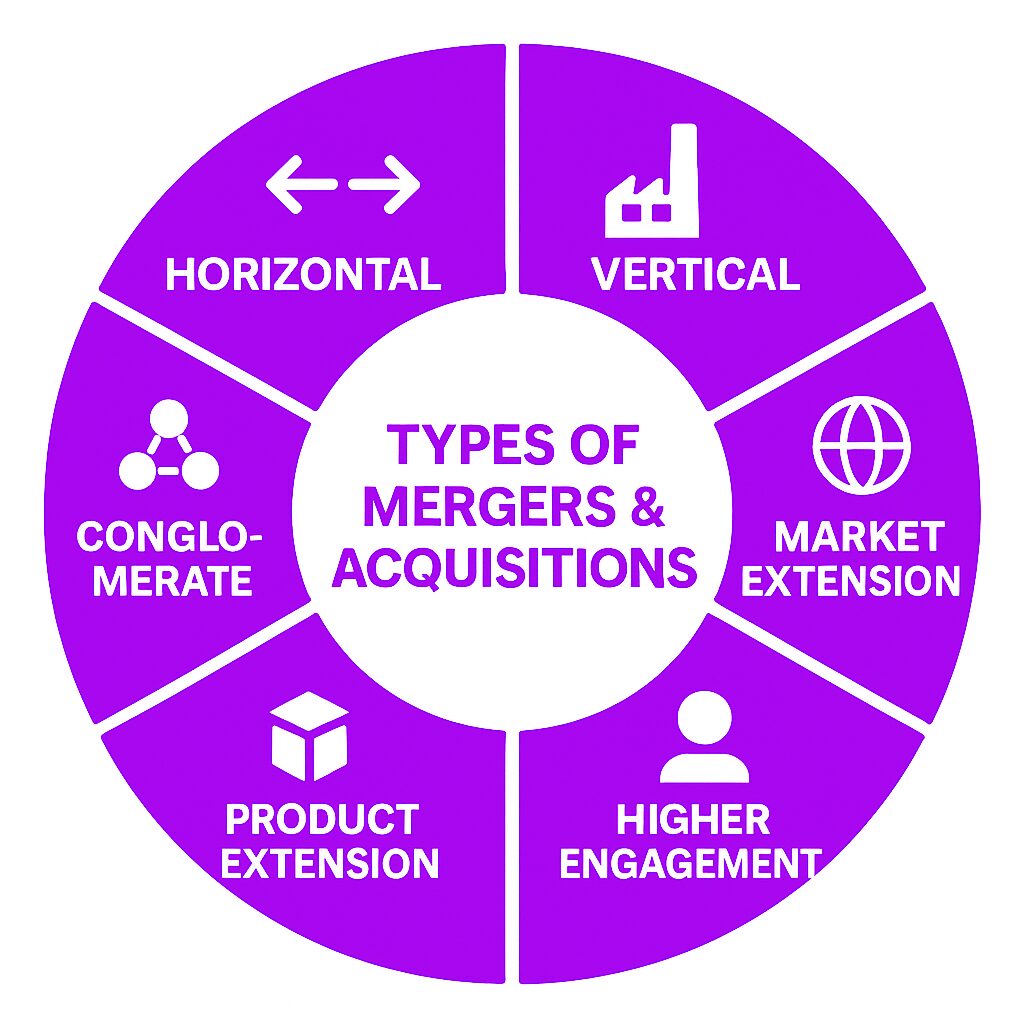

Types of Mergers & Acquisitions

1. Horizontal Merger

A merger occurs when companies combine, particularly two companies that operate in the same industry and are direct competitors. This type of merger helps companies increase market share and reduce competition.

2. Vertical Merger

A merger between companies at different stages of the supply chain. This helps improve operational efficiency and cost savings by reducing dependency on third-party suppliers.

3. Market Extension Merger

A merger between companies that sell similar products but operate in different markets. This allows businesses to expand their reach into new regions.

4. Product Extension Merger

A merger between companies that offer complementary products within the same industry. This expands product lines and increases revenue streams.

5. Conglomerate Merger

A merger between companies in unrelated industries. This strategy helps diversify revenue sources and reduce overall business risk. In conglomerate mergers, the involved companies often form a new legal entity to operate collaboratively.

Purpose and Importance of Mergers & Acquisitions

M&A transactions are driven by strategic business objectives. Companies pursue M&A for several reasons:

-

Market Expansion – Entering new markets to increase sales and growth opportunities.

-

Revenue Growth – Increasing market share and revenue through business consolidation. Acquiring an acquired firm can provide existing assets, customer bases, and operational synergies, enhancing market presence and organizational strength.

-

Operational Efficiency – Reducing costs by eliminating redundant operations.

-

Technology and Talent Acquisition – Gaining access to new technologies, skilled employees, and intellectual property.

-

Competitive Advantage – Strengthening a company’s position within the industry.

Business Valuation

Business valuation is the process of determining the economic value of a business or company. It is a critical component of mergers and acquisitions, as it helps to determine the purchase price of the target company. Accurate business valuation ensures that both the buyer and the seller have a clear understanding of the target company’s worth, facilitating a fair and equitable transaction.

Methods of Business Valuation

-

Discounted Cash Flow (DCF) Analysis: This method involves estimating the present value of the target company’s future cash flows. By projecting the company’s future earnings and discounting them back to their present value, DCF provides a comprehensive view of the target company’s potential profitability.

-

Comparable Company Analysis (CCA): This method involves comparing the target company’s financial metrics to those of similar companies in the same industry. By analyzing the performance of comparable companies, CCA helps to establish a benchmark for valuing the target company.

-

Asset-Based Valuation (ABV): This method involves valuing the target company’s assets, such as property, equipment, and intellectual property. ABV is particularly useful for companies with significant tangible assets, providing a clear picture of the target company’s intrinsic value.

-

Market Capitalization Method: This method involves valuing the target company based on its market capitalization, which is the total value of its outstanding shares. Market capitalization reflects the market’s perception of the company’s value, making it a straightforward and widely-used valuation method.

-

Revenue Multiple Method: This method involves valuing the target company based on its revenue, using a multiple of revenue to determine the purchase price. By applying industry-specific revenue multiples, this method provides a quick and effective way to estimate the target company’s value.

Merger Agreement

A merger agreement is a binding contract between the acquiring company and the target company that outlines the terms of the acquisition. It is a critical document in mergers and acquisitions, as it sets out the terms of the deal and the obligations of both parties. The merger agreement ensures that both the acquiring company and the target company are aligned on the transaction’s specifics, reducing the risk of misunderstandings and disputes.

Key Terms

-

Purchase Price: The amount that the acquiring company will pay for the target company. The purchase price is typically determined through business valuation methods and is a central element of the merger agreement.

-

Closing Date: The date on which the acquisition is expected to be completed. The closing date is crucial for planning the integration of the two companies and ensuring a smooth transition.

-

Conditions Precedent: The conditions that must be met before the acquisition can be completed. These conditions may include regulatory approvals, shareholder approvals, and other legal requirements that must be satisfied to finalize the deal.

-

Representations and Warranties: The statements made by the target company about its business and financial condition. These assurances help the acquiring company assess the target company’s viability and identify any potential risks.

-

Indemnification: The agreement by the target company to indemnify the acquiring company against any losses or damages. Indemnification provisions protect the acquiring company from unforeseen liabilities and ensure that the target company is accountable for any misrepresentations or breaches of the agreement.

By understanding these key terms, both the acquiring company and the target company can navigate the complexities of the merger agreement and work towards a successful acquisition transaction.

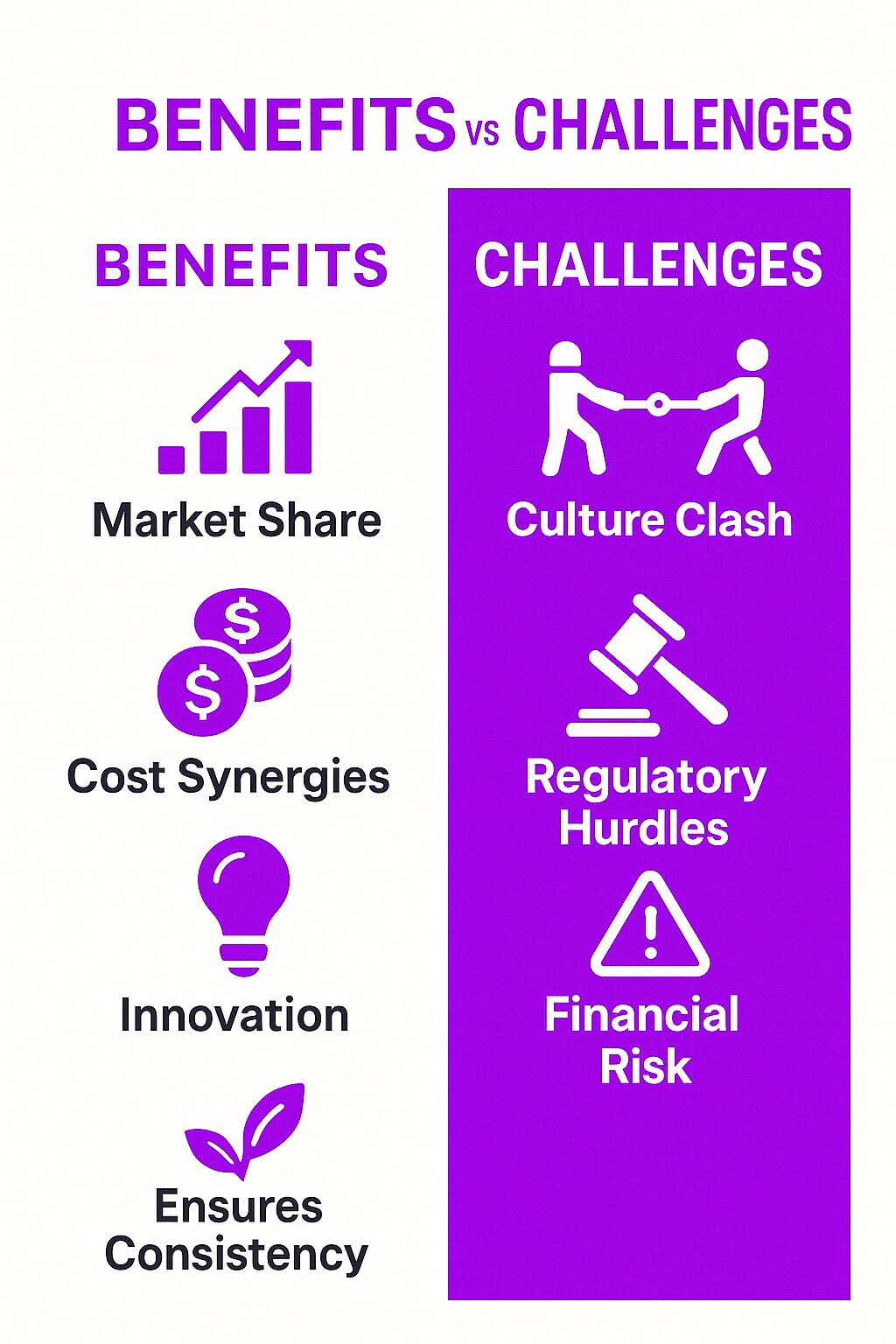

Benefits and Challenges of Mergers & Acquisitions

Benefits

Increased Market Share

Combining companies can create a dominant player in the industry, leading to a stronger market position.

Cost Savings Through Synergies

M&A transactions often result in cost savings through operational efficiencies, reduced overhead, and better supply chain management.

Access to New Customers

Merging with or acquiring another company expands customer bases and geographical reach.

Enhanced Innovation

Pooling resources and expertise can lead to greater innovation and product development.

Challenges

Cultural Integration

Merging two different workplace cultures can lead to conflicts and employee dissatisfaction.

Regulatory and Legal Hurdles

Governments may scrutinize large M&A deals to ensure they don’t create monopolies or reduce competition.

Financial Risk

If not managed properly, M&A transactions can lead to debt, operational inefficiencies, or unexpected costs.

Employee Uncertainty

Job redundancies and restructuring can lead to uncertainty and morale issues among employees.

Best Practices for Successful Mergers & Acquisitions

Define Clear Objectives

Companies should have a well-defined strategy for why they are pursuing M&A and what they hope to achieve.

Conduct Thorough Due Diligence

Extensive research into the financial, operational, and cultural aspects of the target company reduces risks and prevents unexpected surprises.

Communicate Transparently

Clear communication with employees, stakeholders, and customers helps manage expectations and reduce uncertainty.

Plan for Integration

A detailed integration plan ensures that operations, technology, and employees transition smoothly into the new organization.

Monitor Post-Merger Performance

Tracking key performance indicators (KPIs) helps companies assess whether the M&A has met its strategic goals.

Related Concepts in Mergers & Acquisitions

Hostile Takeover vs. Friendly Merger

A hostile takeover occurs when a company acquires another without the target company’s approval. In contrast, a friendly merger is a negotiated and mutually agreed-upon transaction.

Additionally, a private company can utilize a reverse merger to become publicly listed quickly by acquiring a publicly traded shell company, thus accessing public markets and potential investors for faster financing and growth.

Leveraged Buyout (LBO)

A leveraged buyout involves purchasing a company using a significant amount of borrowed money, with the acquired company’s assets serving as collateral.

Synergies in M&A

Synergies refer to the added value that results from combining two companies, such as cost reductions or increased revenue.

Real-World Examples of Mergers & Acquisitions

Successful M&A Deals

-

Disney & Pixar (2006) – Disney acquired Pixar to enhance its animation division and storytelling capabilities.

-

Facebook & Instagram (2012) – Facebook’s acquisition of Instagram helped it dominate the social media market and expand advertising revenue.

-

Amazon & Whole Foods (2017) – Amazon’s acquisition of Whole Foods enabled it to enter the grocery industry and expand its retail footprint.

Failed M&A Deals

-

AOL & Time Warner (2000) – A highly publicized merger that failed due to culture clashes and poor strategic alignment.

-

Daimler & Chrysler (1998) – A merger that ended in failure due to operational differences and lack of synergy.

Final Thoughts

Mergers and acquisitions are powerful tools for business growth and expansion. While they offer significant benefits, they also come with risks that require careful planning and execution. Companies that approach M&A with a clear strategy, thorough due diligence, and a strong integration plan increase their chances of long-term success.